colorado springs vehicle sales tax rate

Columbine CO Sales Tax Rate. The rate then goes down to 15 percent for the second year of service 12.

Financial Tip Of The Month Tax Prep Checklist Tax Prep Checklist Tax Prep Small Business Tax

This is the total of state county and city sales tax rates.

. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The Colorado Springs sales tax rate is. During the vehicles first year of service the rate is 21 percent.

Two services are available in Revenue Online. The colorado springs colorado general sales tax rate is 29. 6 rows The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state.

4 rows The current total local sales tax rate in Colorado Springs CO is 8200. Colorado collects a 29 state sales tax rate on the purchase of all vehicles. You can find these.

In Colorado localities are allowed to collect local sales taxes of up to 420in addition to the Colorado state sales tax. Colorado springs city rates 29 is. The Colorado sales tax rate is currently.

You can Get the Colorado springs car sales tax files here. Use 38 Sales 39. 5 Food for home consumption.

Fountain Live in Buy in. Effective January 1 2016 through December 31 2020 the City of Colorado Springs sales and use tax rate is 312 for all transactions occurring during this date range. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

The 82 sales tax rate in colorado springs consists of 29 colorado state sales tax 123 el paso county sales tax 307 colorado springs tax and 1. View Business Location Rates. Colorado collects a 29 state sales tax rate on the purchase of all vehicles.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. The vehicle is principally operated and maintained in Colorado Springs. Conejos County CO Sales Tax Rate.

Use 20 Sales 375. To cite an example the total sales tax charged for residents of Denver amounts to 772 percent. Licensed retailers can find rate and jurisdiction code information for.

Although the taxes charged vary according to location the taxes include Colorado state tax RTD tax and city tax. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. The Colorado sales tax Service Fee rate also known as the Vendors Fee is 00333 333.

The maximum tax that can be owed is 525 dollars. View Local Sales Tax Rates. The Colorado sales tax rate is currently.

Of the forty-five states and the District of Columbia with a statewide sales tax Colorados 29 percent rate is the lowest. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax. This is the total of state and county sales tax rates.

The rate then goes down to 15 percent for the second year of service 12. Rates include state county and city taxes. The Colorado state sales tax rate is currently.

During the vehicles first year of service the rate is 21 percent. Sales Tax State Local Sales Tax on Food. Commerce City CO.

Calculate Car Sales Tax in Colorado Example. The County sales tax rate is. Sales Tax 50000 - 10000 029 Sales Tax 1160.

Colorado State sales tax rate is 29 percent. Colorado collects a 29 state sales tax rate on the purchase of all vehicles. The 2018 United States Supreme Court decision in South Dakota v.

Find both under Additional Services View Sales Rates and Taxes. Use 20 Sales 375. Sales Tax Rates in Revenue Online.

To review the rules in Colorado visit our state. Monument Live in Buy in. Real property tax on median home.

Columbine Valley CO Sales Tax Rate. The latest sales tax rates for cities starting with A in Colorado CO state. To find out your auto sales tax take the sales price of your vehicle and calculate 772 percent of this price.

Did South Dakota v. 5 rows The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales. This service provides tax rates for all Colorado cities and counties.

Sales Tax for Vehicle Sales DR 0024 Form After completing this course you will be able to do the following. Manitou Springs Live in Buy in. The Colorado Springs sales tax rate is.

Background - Understand the importance of properly completing the DR 0024 form. Colorado Springs CO Sales Tax Rate. Remember that the total amount you pay for a car out the door price not only includes sales tax but also registration and dealership fees.

Get all royalty-free photos. The El Paso County sales tax rate is. DR 0800 - Use the DR 0800 to look up local jurisdiction codes.

2020 rates included for use while preparing your income tax deduction. All PPRTA Pikes Peak Rural Transportation Authority. Colorado springs car sales tax are a topic that is being searched for and liked by netizens now.

In addition to taxes car purchases in Colorado may be subject to other fees like registration title and plate fees. Box 15819 Colorado Springs CO 80935-5819. The Index measures the state and local sales tax rate in each state.

DR 0100 - Learn how to fill out the Retail Sales Tax Return DR 0100. This is the estimated amount that you will have. Vehicle Fee Vehicle Fee Motorcycle 490 Motorcycle 1300.

When purchasing a new car the individual p roperly paid city sales tax to the dealer and registered h. DR 0100 - Learn how to fill out the Retail Sales Tax Return DR 0100. A Colorado Springs resident owns a home in the C ity and a ranch in the mountains.

What is the sales tax rate in Colorado Springs Colorado. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Has impacted many state nexus laws and sales tax collection requirements.

Sales Tax Information Colorado Springs

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

To Win At The Tax Game Know The Rules Published 2015 Income Tax Return Tax Forms Income Tax

Health Insurance Tax Health Insurance Infographic Infographic Health Health Insurance

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Layers Of Taxation Factor Into Colorado Vehicle Purchases Business Gazette Com

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

How Colorado Taxes Work Auto Dealers Dealr Tax

How Colorado Taxes Work Auto Dealers Dealr Tax

How Colorado Taxes Work Auto Dealers Dealr Tax

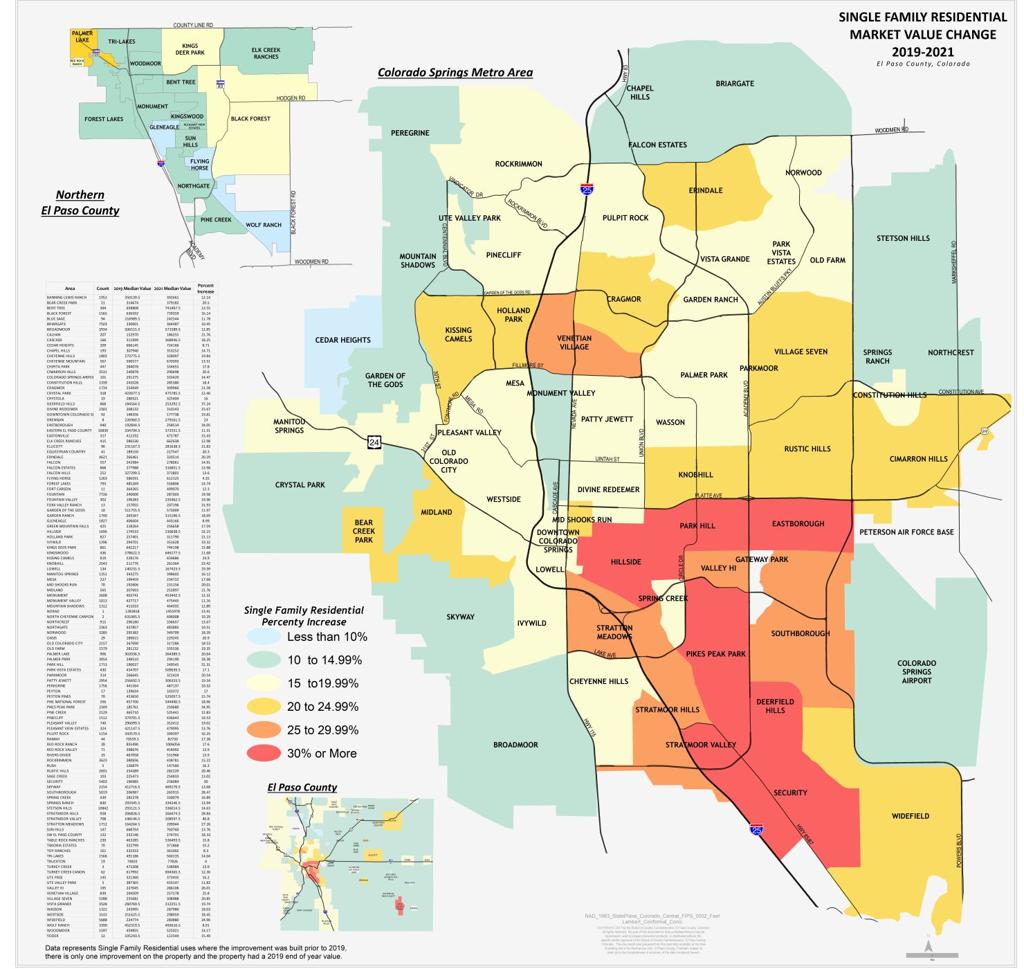

Increased Tax Bills Expected For Most El Paso County Property Owners Assessor Says News Gazette Com

Sales Taxes In The United States Wikiwand

2021 Arizona Car Sales Tax Calculator Valley Chevy

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

How Colorado Taxes Work Auto Dealers Dealr Tax

Irs Tax Forms Infographic Tax Relief Center Irs Tax Forms Irs Taxes Tax Forms

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Tax Deductions Printable Checklist Free Printables